[Important content update: Housesimple is now called Strike and its property selling service is now 100% FREE. That means with Strike you can sell your property with no estate agent’s fees. For fully updated information on this opportunity to sell your home without paying a estate agent please visit the Strike website.]

Purplebricks online estate agent launched on the London Stock Exchange today with a valuation of £240 million. Incredibly, the company was only formed in April 2012 and in the aftermath of a disastrous business venture that had left the founders, brothers Michael and Kenny Bruce, down but definitely not out.

The Rapid Rise of Purplebricks from Idea to IPO

Selli![]() ngUp.com has put together a timeline charting the rapid rise of Purplebricks from before the domain name was registered to their IPO (Initial Public Offering) on the London Stock Exchange. It shows step-by-step how the Bruce brothers turned their vision for a property revolution into a financial phenomenon in under four years.

ngUp.com has put together a timeline charting the rapid rise of Purplebricks from before the domain name was registered to their IPO (Initial Public Offering) on the London Stock Exchange. It shows step-by-step how the Bruce brothers turned their vision for a property revolution into a financial phenomenon in under four years.

NEW! COMPARE OTHER ONLINE AGENTS »

January 2012

- Northern Irish Brothers Michael and Kenny Bruce shut down their struggling business venture JKM Property Solutions, a company that worked with estate agents to sell properties in need of refurbishment. The failure of JKM means no return on the estimated £1.5m invested.

- The Bruce brothers, who had made an undiscloded sum some months earlier by selling their 16-branch Midlands estate agent to a larger rival, now turn their attention on an entirely new scheme – the ‘world’s first 24 hour estate agent’ which will combine cutting edge technology with local property expertise.

The entreprenurial Brothers Michael (left) Kenny Bruce who founded Purplebricks

March 2012

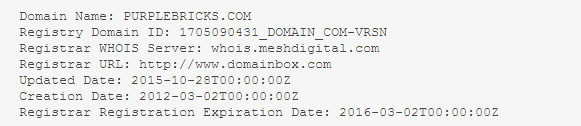

- The domain name Purplebricks.com is registered.

April 2012

- New Broom Ltd., the company behind Purplebricks is formally incorporated. Borrowed from the phrase a new broom sweeps clean, the company name signals a stated intention to radically reshape the residential property market in the UK.

- An extensive two-year £1m software development phase begins which will eventually lead to the launch of the Purplebricks proprietory eZie® Platform for managing the entire property sales process.

January 2013

Purplebricks director Will Whitehorn (left) with former boss Sir Richard Branson. Image: Wikipedia

- Sir Richard Branson’s former right-hand man Will Whitehorn, ex-president of Virgin Galactic joins the Purplebricks team as non-executive director. He is accompanied by James Kydd, former managing director of brand and marketing at Virgin Media, who takes up the role of marketing director.

March 2014

- Former Capita Chief Executive Paul Pindar makes a ‘significant investment’, as part of a multimillion-pound fundraising round, in which Martin Bolland, Capita’s non-executive chairman and the co-founder of private equity house Alchemy Partners, also takes a stake.

- The remaining investor in Purplebricks is DN Capital, a technology fund that has previously backed Shazam, the music mobile app recently valued at £300m.

April 2014

- Purplebricks.com officially launches, billing itself as the world’s first 24 hour estate agent. The company is marketed as a ‘hybrid estate agent’ because it combines the fixed fee and technology tools of online estate agents with the local market expertise of a traditional agency through its network of Local Property Experts.

NEW! COMPARE OTHER ONLINE AGENTS »

June 2014

- It is revealed that Errol Damelin, founder of the payday lender Wonga has invested an undisclosed sum in Purplebricks.

- Purplebricks receives its first review on Trustpilot.com – a 5 star rating. By December 2015 Purplebricks has accrued more than 3000 reviews and has maintained its “Excellent” 5 star rating with an average customer score of 9.4/10.

- Independent analysis of major property portals Rightmove and Zoopla by SellingUp.com reveals Purplebricks has approximately 400 properties listed for sale.

August 2014

- Former Invesco Pertual star City of London fund manager Neil Woodford invests £7m into Purplebricks. Existing investors Paul Pinder, Martin Bolland and DN Capital provide a further £1m between them. Woodford’s stake means he controls a 30% share of the business.

City fund manager Neil Woodford becomes the major investor in Purplebricks

September 2014

Purplebricks hires businesswoman Sarah Willingham to feature in a promotional video on YouTube. Willingham will go onto become famous as one of the BBC’s Dragon’s Den investors.

NEW! COMPARE OTHER ONLINE AGENTS »

November 2014

Leading online marketing expert Joby Russell is appointed as a director of Purplebricks.com, a role he will carry out in addition to his position as marketing director at the insurance comparison site Confused.com.

February 2015

- Purplebricks launches targeted TV advertisements that deliver customised ads to viewers based on their postcode areas. The campaign uses Sky Media’s new AdSmart platform.

- SellingUp.com research reveals Purplebricks has become the biggest online estate agent with over 1600 properties for sale.

March 2015

- Canadian firm is Canaccord Genuity is appointed to oversee preparation for a potential stock market floatation.

- Purplebricks announces it has to date sold more than 2000 properties and claims to be the fastest growing online agent, scaling at a rate of 50 per cent every three months.

May 2015

- Paul Pindar, who owns about 5 per cent of Purplebricks, tells Reuters that a stock market flotation for the online agent in 2016 is likely.

- Purplebricks completes it national roll-out by launching across London – the prestigious market seen as a key territory in the UK property industry.

- Chief executive Michael Bruce tells the London Evening Standard that the firm is growing at a rate of 25% per month.

- Purplebricks is named as No.1 Startup of the year by Startups 100, which claims to be the definitive index of the UK’s 100 fast growth-potential new businesses.

- Joby Russell leaves his role as Marketing Director at Confused.com after six years and takes up full time position of Chief Marketing Officer at Purplebricks.com. Former marketing chief James Kydd stays on as a director working on special projects.

Joby Russell leaves Confused.com to become Purplebricks’ marketing chief

June 2015

- Purplebricks expands its reach by launching in Northern Ireland, the country where its founders, the Bruce brothers, were born and raised.

- Purplebricks announces that it now employs 150 people across the UK.

July 2015

- Woodford Investment Management, raises its stake in Purplebricks to more than 25% following a £10m share sale. When Woodford first invested £7m in August 2014 its stake was worth 30%, but as the company’s value has risen and others have invested his proportion dropped. This latest investment sees Woodford’s ownership status rise again.

August 2015

- Two former Virgin brand and marketing senior executives who have been with Purplebricks since before it offically launched, become company board members. Will Whitehorn, who led Virgin’s move into trains and ran the PR campaign against British Airways, remains a non-executive director but gets a seat in the boardroom, while former Virgin Media boss James Kydd, who founded Virgin Mobile and the V Festival, is named marketing director of Purplebricks.

NEW! COMPARE OTHER ONLINE AGENTS »

November 2015

- Purplebricks launches in Scotland, completing its plan for total UK coverage.

- Sky TV breaks the news that Purplebricks is planning to launch on the London Stock Exchange in December. No details are provided other than speculation that the market value of Purplebricks.com at floatation would be around £250million.

- Purplebricks publicises its claim to being the fourth largest estate agency in the UK. In what is considered by the media to be a sales pitch to potential investors, the company puts itself in fourth place behind Countrywide, Connells and LSL, but ahead of Foxtons, Spicerhaart, Kinleigh Folkard & Hayward, and Savills.

- Purplebricks reveals that of its 150 local property experts, 89% are self employed but operating under a license and 11% are actually employed by the company.

- Purplebricks wins the Startups Awards Tech Business of the Year accolade.

The Purplebricks team, (including CEO Michael Bruce, centre) collect the Startups Awards Tech Business of the Year prize. Photo by David McHugh

December 2015

- Purplebricks officially announces it is to join the London Stock Exchange on December 17, as part of the AIM (Alternative Investment Market). The company has provisionally sold £58 million worth of shares, mostly to three major corporate investors: Old Mutual GI, Artemis Asset Management Ltd. and FIL Investments International. The sale gives Purplebricks a £240 million market capitalisation (or ‘paper value’).

- As part of a statement via London Stock Exchange, Purplebricks claims to have approximately 4,300 residential properties for sale, which it says represents more than twice the number of properties as the next largest online agency.

- Zeus Capital is named as Purplebrick’s Nominated Adviser and Broker to handle the process of making shares available for trading, while global law firm Norton Rose Fulbright are advising on the legal aspects.

- It is revealed that the Purplebricks stock will be listed under the ticker symbol PURP.L and trading is expected to start on AIM on December 17, 2015 at 8am. The IPO will raise £25m for the company which it will invest in further growing the business. Some directors and investors will cash in shares worth £33m.

- December 17, 2015 – Purplebricks becomes the first online estate agent to list on the London Stock Market. Among those selling shares are the company’s founders, the Bruce Brothers. CEO Michael Bruce will dispose of 6.91% of the company, reducing his ownership from 23.94% to 17.03%. Kenny Bruce is selling 1.94% of the company by reducing his holding from 6.99% to 5.05%. Between them the Bruce brothers will have made more than £20 million from the stock market floatation alone, while retaining stock worth at the launch valuation in excess of £50 million.

[Important content update: Housesimple is now called Strike and its property selling service is now 100% FREE. That means with Strike you can sell your property with no estate agent’s fees. For fully updated information on this opportunity to sell your home without paying a estate agent please visit the Strike website.]